Life insurance may often form part of your long-term financial planning, with the certainty that if you pass away while your policy is in good standing, your nominated beneficiaries will receive a payment to help with funeral expenses and ongoing living costs. It is important to review all the varied types of life insurance and take the time to research the policy benefits and costs to ensure you make informed decisions about the type of life insurance you need.

Understanding Varied Types of Life Insurance

Key Takeaway

What Are the Basic Features of Life Insurance Policies?

A life insurance policy's primary function is paying a death benefit to your beneficiaries if you pass away. Several variables can impact the death benefit of your life policy, although you can usually select the benefit value and term at the point of purchase.

Other policy features and phrases to be aware of when purchasing life insurance include the premium, or the amount payable; the policy term, which dictates when the insurance policy may become invalid; and the maturity date (when a policy becomes inactive).

The Pros and Cons of Popular Types of Life Insurance Products and Structures

The major types of life insurance are term and permanent coverage but there are many sub-types like variable life policies.

Term life coverage lasts a fixed period, such as ten, twenty, or thirty years. With this type of policy, insurance policyholders can often select their expiry date, such as purchasing term life coverage that lasts until children reach adulthood.

Whole life or permanent life insurance does not expire as long as premiums are paid, and although the policy premiums tend to be higher, they may remain static for the duration of the insurance coverage. The major advantage of term life insurance is that the coverage is more affordable and can last for a set period of time.

Whole life tends to carry higher premiums but provides the assurance of permanent coverage for life. It usually comes with an account value feature, which earns interest or dividend returns, allowing this to grow over time.

While countless possible life policy variations may appeal, we have summarized below some of the more common options that showcase how both classifications of life coverage may be advantageous.

Type of Insurance Term Life Insurance Coverage Fixed period (10, 20, 30 years) Benefit Pays death benefit if policyholder passes within term Cash Value No cash value Loans No |

Type of Insurance Whole Life Insurance Coverage Lifetime coverage Benefit Guaranteed death benefit Cash Value Yes, accumulates over time Loans Yes |

Type of Insurance Universal Life Insurance Coverage Lifetime coverage with flexible premiums Benefit Adjustable death benefit Cash Value Yes, can accumulate and be used for premiums Loans Yes |

Type of Insurance Guaranteed Life Insurance Coverage Lifetime coverage, limited eligibility Benefit Guaranteed approval, lower death benefit Cash Value No Loans No |

Type of Insurance Indexed Universal Life Insurance Coverage Lifetime coverage with flexible premiums Benefit Adjustable death benefit Cash Value Yes, growth tied to market index Loans Yes |

Type of Insurance Variable Life Insurance Coverage Lifetime coverage Benefit Investment-linked death benefit Cash Value Yes, based on investment performance Loans Yes |

Variations on Life Insurance Coverage

Different Types of Term Life Insurance Coverage

The big contrasts between term life coverage policies relate to how the insurance premiums are calculated:

- Level term insurance has a fixed expiry date, a confirmed death benefit throughout, and a premium that does not change for the duration of policy.

- Renewable annual term insurance is set up one year at a time, with the potential for insurance premiums to increase at each policy renewal date.

- Decreasing term coverage has an insurance premium that reduces over time, but those reductions also link to a gradually lowering death benefit.

Each has positive and negative aspects. For example, decreasing term coverage is often used to cover the outstanding value of a mortgage–but the right options will depend on your expectations.

Different Types of Permanent or Whole Life Insurance

Permanent life coverage has many possible structures and options, although this type of insurance is intended to last for life, provided you keep up with the policy premiums. It is important to note that the death benefit may decrease if you take a loan or withdraw from an account value feature and do not repay this policy loan. Otherwise, the benefits payable should remain constant.

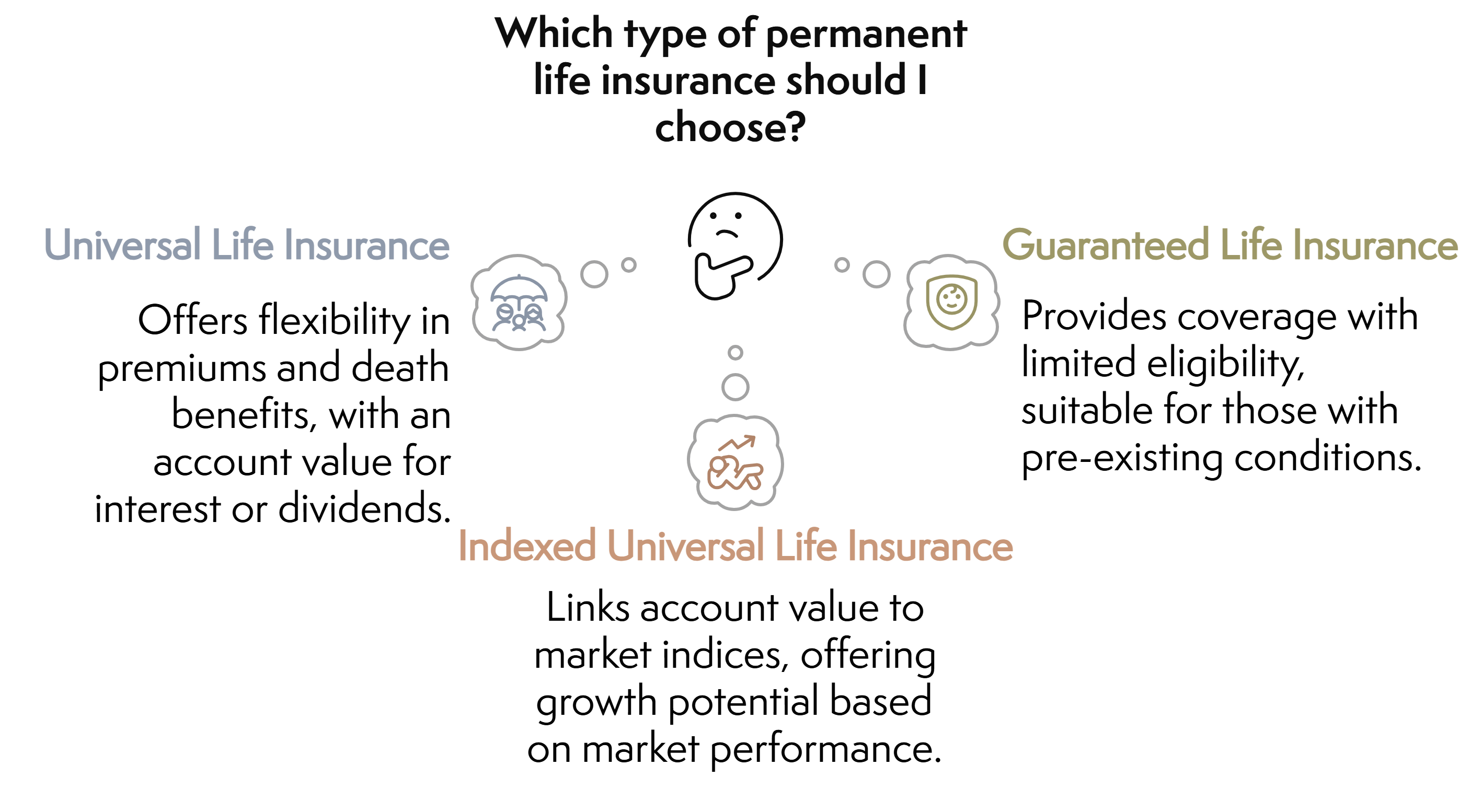

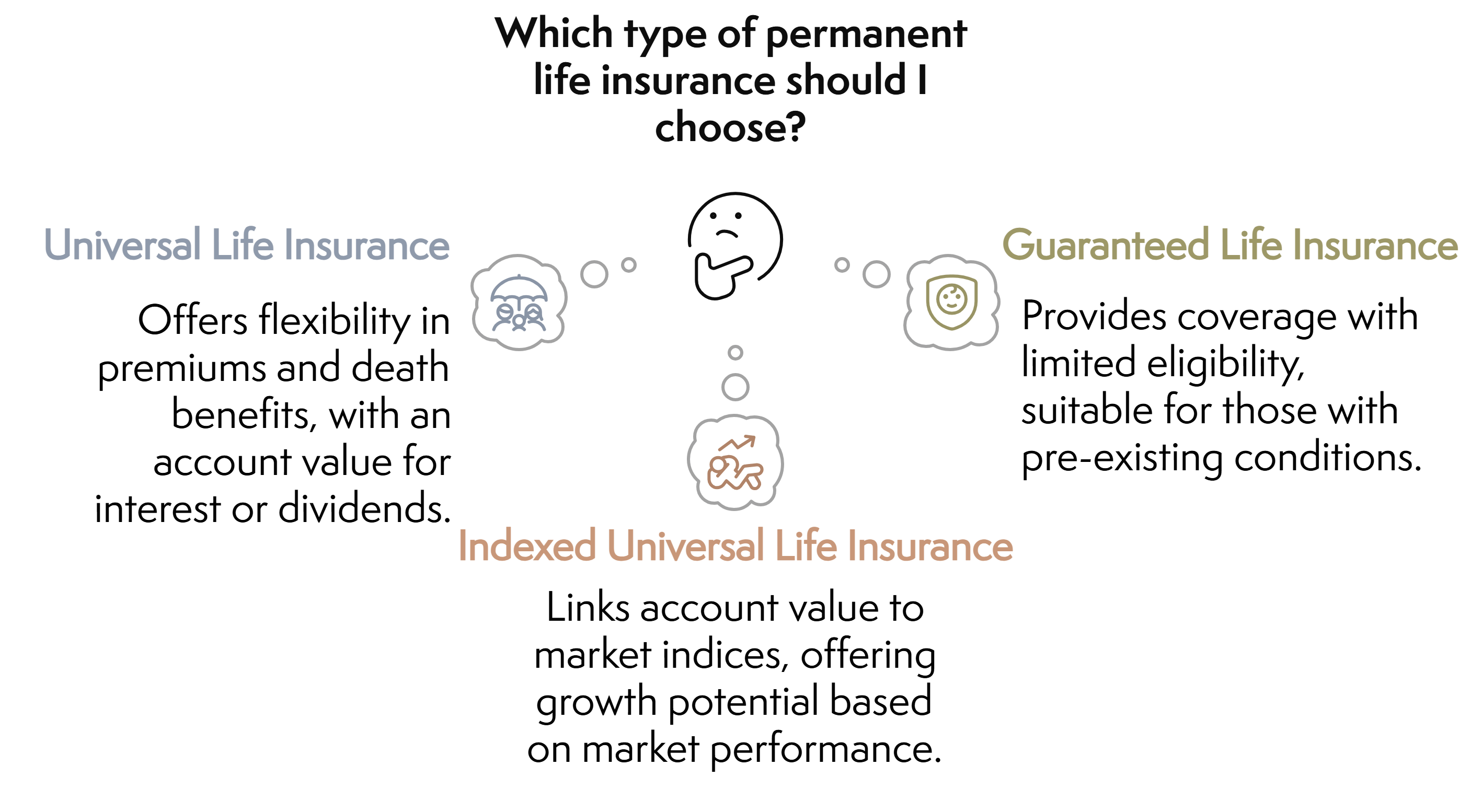

As a quick glimpse into the types of permanent life insurance you might choose between, policy options include:

- Universal life insurance: This insurance coverage provides flexibility with your premiums and death benefits. The policy also has an account value that can be used to accumulate interest or dividends, and then used to help cover premiums.

- Guaranteed life insurance has very limited eligibility criteria and is often designed for people with pre-existing conditions. The death benefit is typically capped, but insurance policyholders can purchase life coverage even if they would be ineligible for another policy.

- Indexed universal life coverage works as above but with an account value linked to a fund or stock market index. This provides account growth based on the performance of the market index or fund.

Tips on Choosing the Right Type of Life Insurance Policy for You and Your Family

The best life insurance types will differ between two families, and the major decision-making factors include your budget, the amount of death benefit you require, your overall goals, and the degree of financial protection you have elsewhere. For example, if you have a healthy budget and can manage higher insurance premium payments, you could choose a more comprehensive permanent life coverage policy with additional features and a high-growth account value.

Term coverage is more accessible and might be a better option, structured to provide a confirmed death benefit if you pass away while the policy is in force. It’s typically purchased to help provide for your children until they reach an age at which you expect them to be financially independent.

Frequently Asked Questions - Variations & Types of Life Insurance

What is the main benefit of life insurance?

For many families, the death benefit paid to the nominated beneficiaries when the insured person passes away is the primary focus of a life insurance policy. However, the value of that insurance payment and the circumstances in which it can be claimed will vary.

Which are the most popular forms of life insurance coverage?

Permanent and term life insurance are the two main types of coverage. However, there are sub-types of each of those kinds of insurance that can fit particular situations.

Should I buy permanent or term life insurance?

There are no right or wrong answers on the best types of life insurance because the most relevant life coverage will depend on your current circumstances, the amount of financial protection you need, the death benefit you anticipate your loved ones require, and how long you’d like your life insurance to remain valid.

All forms of life insurance may be valuable, but it is up to you to identify your priorities and requirements and compare the products available to make an informed decision. You can talk to a life insurance agent or insurance companies to offer you guidance and resources, and help you find the right policy for your needs.

EL01603A109 (11-24)

This article was generated with the help of artificial intelligence (AI). AI-generated content may occasionally contain errors or misleading information. The information above is for educational use only and does not represent insurance, tax, or legal advice. It is not a recommendation or solicitation to buy insurance. Please talk to your licensed insurance agent for more information about life insurance and your needs. Please consult with the appropriate professional for tax or legal advice. Guarantees are backed by the claims-paying ability of the issuing insurance company.

Article Author: Meredith Bell

Author Bio: Meredith joined Everly in 2022 and has 20+ years of experience in the life insurance industry. She has held various roles in advertising, marketing, communications, sales and distribution support, and product development. Outside of the office, Meredith lives with her daughter Kennedy and their dog Mavis. Meredith enjoys cooking, camping, gardening, hiking, and bourbon (though not always at the same time). She is a live music enthusiast and an avid reader. Her favorite quote is by Thomas Jefferson: "I cannot live without books." Meredith agrees, but would add cheese, movies, and dogs to that list.