When it comes to life insurance, one of the most common questions policyholders have may be whether their policies earn simple or compound interest. This question is especially relevant for those who own permanent life insurance policies with a cash value component. Interest earnings can significantly influence the growth of your policy’s savings over time, which in turn can impact the financial security it provides. Understanding the intricacies of your life insurance policy's interest structure is a key aspect of financial planning.

In this guide, we'll explore the differences between simple and compound interest within life insurance policies and how these affect your financial tool over time.

Is Life Insurance Simple or Compound Interest?

Key Takeaway

The Basics of Interest in Life Insurance

Understanding how interest works in the context of life insurance is vital for making informed decisions about your policy. The interest earned on a life insurance policy is how the cash value of the policy grows over time. Two main kinds of interest can be applied to these policies: simple interest and compound interest. Each method has an impact on the potential growth of cash value, and understanding these can help you choose the right policy for your financial goals.

Simple Interest and Life Insurance

Simple interest is calculated on the principal amount of your policy’s cash value. This means that you earn interest on the original amount you've paid into the policy without considering any interest previously earned.

Fixed Rate: Simple interest is applied at a fixed rate over the life of the policy or for a specified term.

Predictable Growth: The predictability of simple interest makes it easier for policyholders to forecast the future value of their policy's cash value.

Compound Interest in Permanent Policies

In contrast, compound interest means that you earn interest not only on your initial investment but also on the interest that has been added to your policy’s cash value. This can lead to exponential growth over time, especially if the interest is compounded frequently, such as annually or monthly.

Exponential Growth: Compound interest can significantly increase the cash value of a policy, particularly in the long term.

Frequent Compounding: The more frequent the compounding period, the greater the growth of the cash value.

Analysis of Simple versus Compound Interest

The type of interest your life insurance policy accrues can have major implications for its future value.

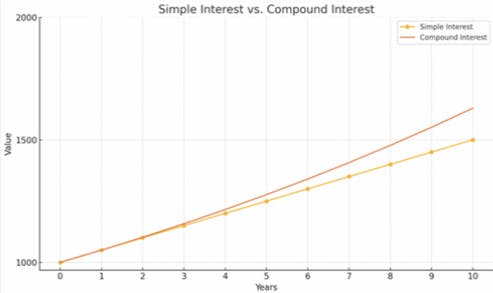

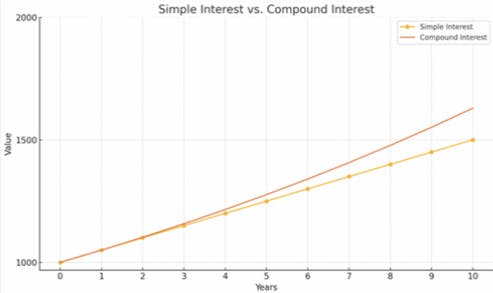

The graph below shows the growth of simple interest versus compound interest over a period of 10 years.

- Simple Interest: Grows linearly based on the principal amount.

- Compound Interest: Grows exponentially as it earns interest on both the initial principal and the accumulated interest.

Calculating Simple Interest in Insurance

Simple interest can be easier to calculate and predict, but it typically offers lower growth potential compared to compound interest.

Calculation: To calculate the simple interest on a life insurance policy, multiply the principal amount of the cash value by the interest rate and then by the number of years the interest is applied.

Example:

Simple Interest = Principal x Interest Rate x Years

How Compound Interest Accumulates

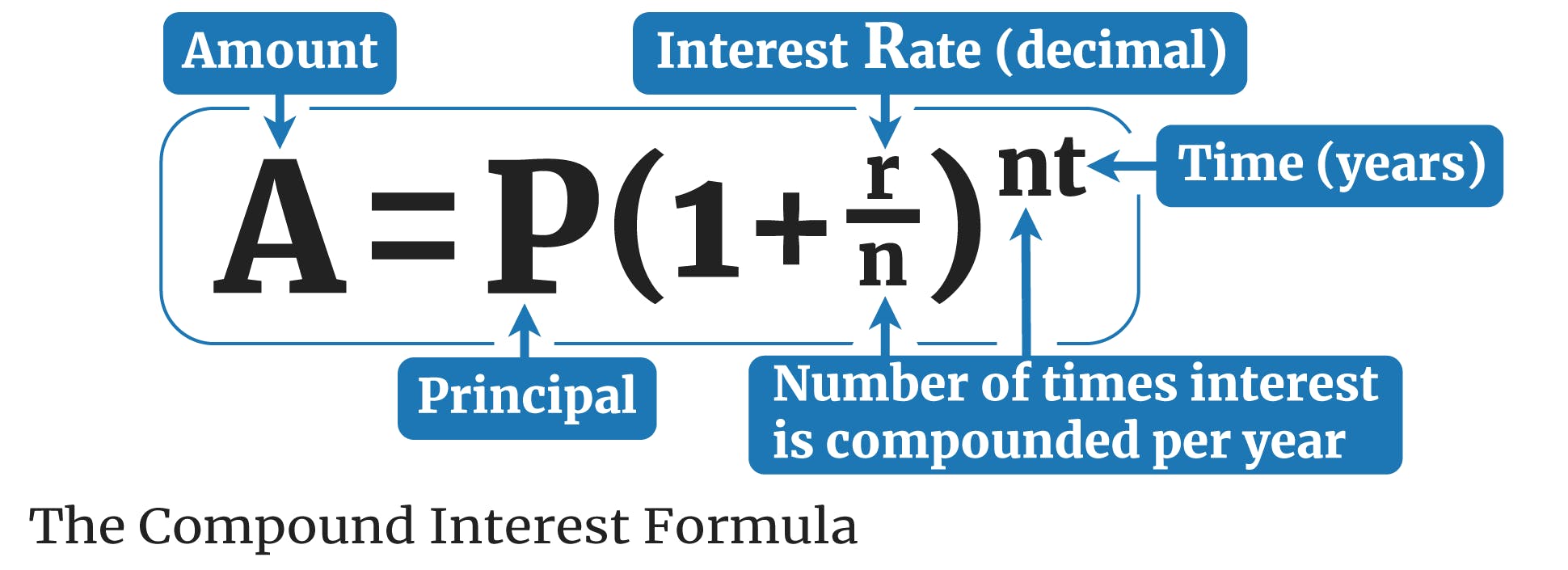

Compound interest involves multiple compounding periods, leading to higher potential growth. With each compounding period, the interest previously added to the cash value earns interest, accelerating the growth.

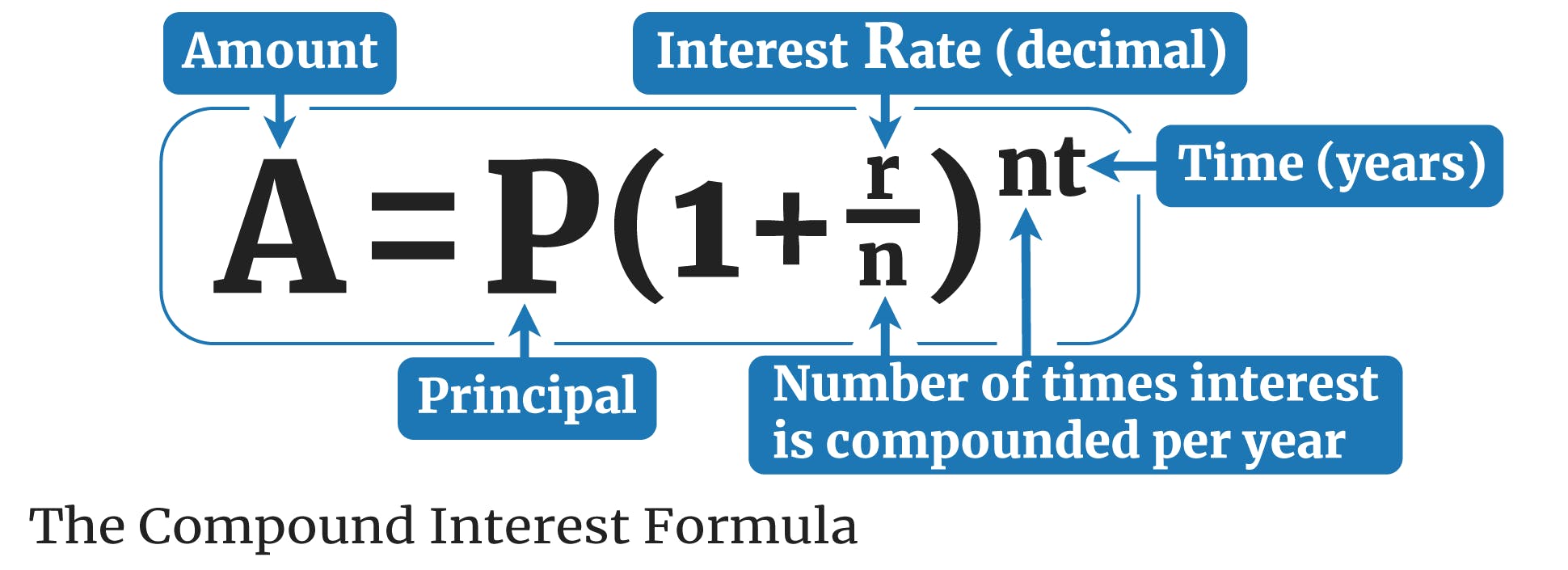

Calculation: The compound interest formula can be more complex due to the compounding frequency.

Example:

Types of Life Insurance and Interest

Different types of life insurance policies handle interest in varying ways. It's important to understand the distinctions to effectively choose the type of life insurance that aligns with your financial goals and the way your cash value may grow.

Term Life Insurance: No Interest Component

Term life insurance policies do not typically have a cash value component, and therefore, interest accumulation is not a consideration.

- Coverage: Designed to provide coverage for a specific period (term).

- Payout: If the insured outlives the term, there is no payout.

- Premiums: Generally lower compared to permanent life insurance policies.

Permanent Life Insurance and Cash Value: Interest Rate

Permanent life insurance policies, such as whole, universal, or variable life, often include a cash value component that can accumulate interest over time.

- Whole Life Insurance: Offers a guaranteed fixed interest rate, providing stable growth of cash value.

- Universal Life Insurance: May offer adjustable rates that can fluctuate with the market, potentially leading to higher returns or increased risk.

- Indexed Universal Life Insurance (IUL): Combines features of universal life insurance with potential for cash value growth based on a stock market index.

Factors Affecting Interest in Life Insurance

Interest rates in life insurance are influenced by various factors, including the general economic environment, the performance of the insurance company's investments, and the specifics of the policy itself.

Policy Type and Interest Rates

The type of life insurance policy you choose will affect the kind of interest your cash value earns, whether it’s at a fixed rate or can vary with market performance.

The Impact of Loans on Life Insurance Interest

Taking loans against your policy's cash value can influence how much interest you earn, potentially reducing the amount available to you or your beneficiaries.

- Outstanding Loans: The outstanding loan amount may accrue interest.

- Impact on Death Benefit: If not repaid, it can diminish the death benefit paid out to your beneficiaries.

FAQ - Frequently Asked Questions about Simple vs. Compound Interest

What determines if my life insurance earns simple or compound interest?

The type of life insurance policy you have, and its terms determine whether it earns simple or compound interest. Whole life policies typically earn compound interest, while some universal life policies may have options for either simple or compound interest.

How does the interest on my life insurance policy impact my premiums?

Interest earnings generally do not impact your premiums directly. However, the growth of your policy’s cash value through interest can affect your overall financial planning and the policy’s ability to support loans or withdrawals.

Can I switch my life insurance policy from simple to compound interest?

Switching between simple and compound interest depends on the terms of your life insurance policy. Some policies may allow adjustments, but it's important to consult with your insurance company to understand the available options and potential implications.

Related Articles

The information above is for educational use only and does not represent insurance, tax or legal advice. It is not a recommendation or solicitation to buy insurance. Please talk to your licensed insurance agent for more information about life insurance and your needs. Please consult with the appropriate professional for tax or legal advice. Guarantees are backed by the claims-paying ability of the issuing insurance company.

Article Author: Meredith Bell

Author Bio: Meredith joined Everly in 2022 and has 20+ years of experience in the life insurance industry. She has held various roles in advertising, marketing, communications, sales and distribution support, and product development. Outside of the office, Meredith lives with her daughter Kennedy and their dog Mavis. Meredith enjoys cooking, camping, gardening, hiking, and bourbon (though not always at the same time). She is a live music enthusiast and an avid reader. Her favorite quote is by Thomas Jefferson: "I cannot live without books." Meredith agrees, but would add cheese, movies, and dogs to that list.