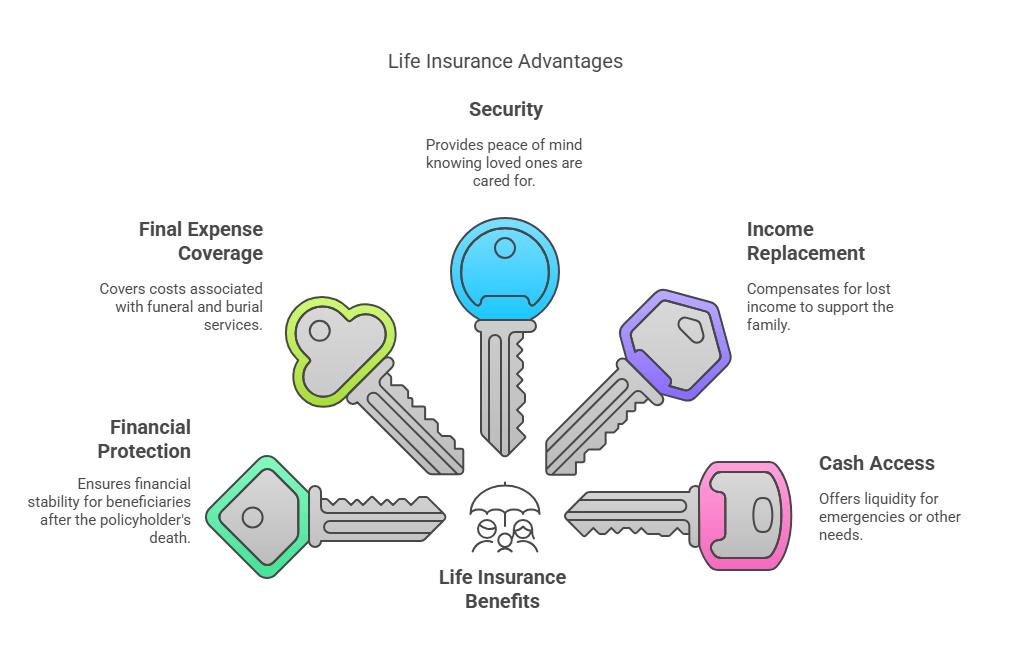

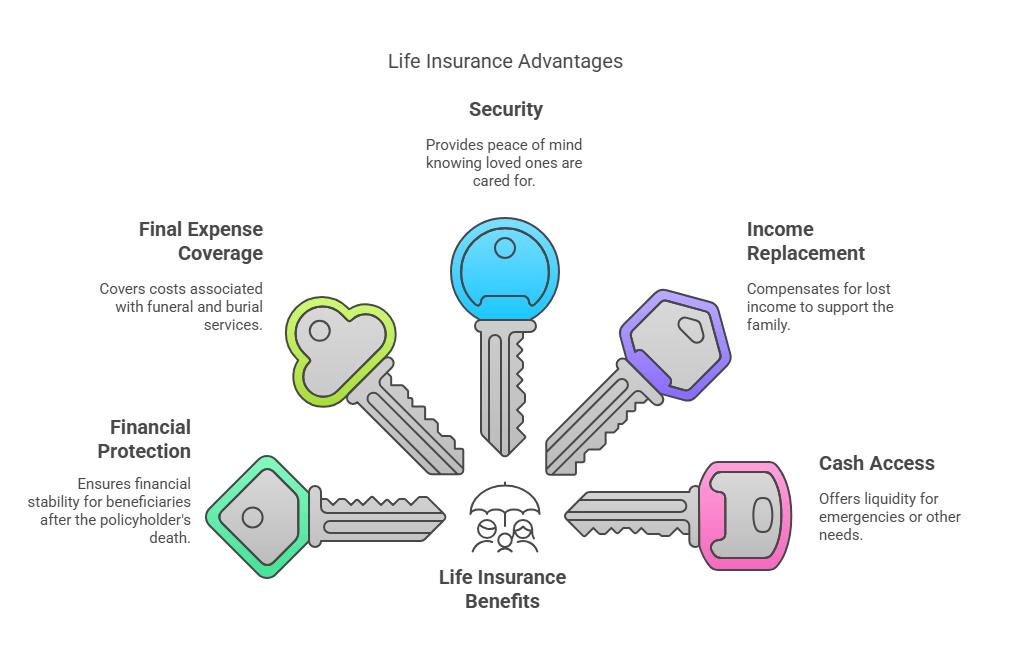

For many policyholders, the most meaningful aspect of buying life insurance is knowing they have planned to pass on a financial legacy to their family and that in the event of their death, their children, spouse, partner, and other relatives will have help in being provided for.

Life coverage can provide a varied and customizable number of additional benefits, with options to increase, decrease, or vary your plan premiums, whole life insurance and annuities that typically remain in force for your entire lifetime, and life insurance with added cover to assist with the costs of a serious illness, care in later life, or an accident that impacts your income.

Advantages of Life Insurance

Key Takeaway

The Advantages of Different Kinds of Life Insurance

Conventional life insurance usually involves a monthly premium, with a confirmed death benefit when you pass away. Numerous policy types offer lump-sum or regular premiums and equally flexible payment structures.

Below, we've given a snapshot of the positive aspects of some of the most popular life insurance products, noting that this is far from an exhaustive list.

- Term life insurance has a defined period and will normally end on the date shown in the plan conditions.

- Whole life coverage is permanent insurance that remains in place for life–usually dependent on maintaining the minimum premiums.

- Indexed life insurance provides an account value that grows much like a savings account, although linked to variable or static interest rates.

- Indexed universal life insurance is another variation of whole life coverage. It enables policyholders to participate in equity index accounts, potentially increasing account value growth.

- Universal life insurance is a permanent, flexible coverage product that enables policyholders to adapt their premiums based on income and accumulated account value.

Every insurance plan has different advantages and possible drawbacks, with varied risk elements, making it essential to conduct thorough research before making financial decisions.

Advantage Financial Protection Term Life Insurance Provides a death benefit for a set term (10, 20, or 30 years). Whole Life Insurance Guaranteed death benefit for life as long as premiums are paid. Universal Life Insurance Permanent coverage with flexible premiums and death benefit. Indexed Universal Life Insurance Permanent coverage with potential for cash value growth. |

Advantage Covers Final Expenses Term Life Insurance Covers funeral costs, debts, and medical bills if the insured passes during the term. Whole Life Insurance Guaranteed payout can cover final expenses at any age. Universal Life Insurance Can provide final expense coverage if policy remains active. Indexed Universal Life Insurance Can cover final expenses while allowing account value growth. |

Advantage Income Replacement Term Life Insurance Replaces lost income for dependents if the insured passes during the term. Whole Life Insurance Provides lifelong income replacement with cash value benefits. Universal Life Insurance Death benefit can be adjusted to replace income as needed. Indexed Universal Life Insurance Flexible death benefit can support income replacement. |

Advantage Access to Cash Term Life Insurance No cash value or loan options. Whole Life Insurance Cash value accumulates over time and can be borrowed against. Universal Life Insurance Accumulates cash value that can be accessed through loans or withdrawals. Indexed Universal Life Insurance Cash value is linked to an equity index and can be withdrawn or borrowed. |

Advantage Security & Stability Term Life Insurance Premiums are fixed for the term but increase upon renewal. Whole Life Insurance Fixed premiums provide lifetime stability. Universal Life Insurance Flexible premiums allow policyholders to adjust payments. Indexed Universal Life Insurance Policyholder can adjust premiums while earning interest based on an index. |

Advantage Tax-Advantaged Savings Term Life Insurance No savings or tax advantages. Whole Life Insurance Cash value grows tax-deferred and may earn dividends. Universal Life Insurance Tax-deferred growth on cash value with flexible contributions. Indexed Universal Life Insurance Potential for higher tax-advantaged growth based on market performance. |

Advantage Flexible Payment Options Term Life Insurance Fixed premiums for the chosen term. Whole Life Insurance Level premiums remain the same throughout the policy. Universal Life Insurance Policyholders can adjust premiums and death benefit. Indexed Universal Life Insurance Premium payments and coverage amounts are adjustable. |

Advantage Optional Riders for Customization Term Life Insurance Riders like critical illness or accidental death may be available. Whole Life Insurance Offers various riders, such as long-term care or disability waiver. Universal Life Insurance Multiple rider options, including premium waivers and living benefits. Indexed Universal Life Insurance Can include riders for enhanced benefits like long-term care. |

Advantage Retirement & Investment Benefits Term Life Insurance No investment or retirement benefits. Whole Life Insurance Cash value can supplement retirement income through withdrawals or loans. Universal Life Insurance Cash value can be used as a retirement income supplement. Indexed Universal Life Insurance Indexed accounts provide growth potential for retirement planning. |

How to Get More Value When Buying Life Insurance

The first step to ensuring your life insurance fits your requirements is to evaluate the death benefit, features, potential account value accumulation, and premiums available through the varied life coverage products we've summarized. Modern life insurance isn’t restricted to a one-off death benefit, and can provide:

- Guaranteed insurance payments for life, a stable income in retirement, or a lump-sum payment to the policyholder or their beneficiary

- Living benefits and features to enable policyholders to access life insurance benefits while still living if they are diagnosed with a covered illness.

- Optional riders to add, increase, or vary the coverage, including riders to protect against unforeseen circumstances

Auditing your savings, investment products, social security benefits, other insurance coverage, and financial resources is the best starting point because this can highlight the minimum death benefit you require and any possible gaps in your financial planning.

Tips on Purchasing Life Insurance With Confidence

According to industry data*, It is significantly more common for couples and families to discover they are underinsured rather than overinsured, and it is common for policyholders to miss out on options to capitalize on their product's added benefits or features. Pinpointing your core objectives will ensure you make informed decisions, whether you wish to purchase life insurance to:

- Provide a confirmed death benefit for your loved ones

- Maximize the income available to you in retirement

- Accumulate tax-advantaged savings

It is worthwhile reviewing any no-cost riders included within a policy and considering additional riders that could enhance the value of your coverage, provided the cost remains within budget.

Finally, shopping around, comparing products, seeking independent advice, and taking all the time you need to review policy terms, conditions, coverage, and limitations will help ensure you pick the most cost-effective plan that fits into your broader financial plans.

Life Insurance: An Underutilized Financial Tool?

Death benefits and guaranteed financial protection are undoubtedly valuable. However, many policyholders also select life insurance products that offer additional features, such as the ability to participate in equity markets or contribute flexible premiums to grow the account value faster than a comparable savings product.

There are alternative ways to leverage the features rolled into a life coverage policy, such as accumulating an account value to draw on as an accessible loan or lump-sum withdrawal to help finance retirement, relocation, or other planned expenditures. It remains key to stay current with life insurance premiums and recognize how unrepaid loans or withdrawals may affect the policy death benefits.

Still, the freedom to structure coverage according to your wishes and choose between a growing range of specialist, niche, and personalized products can make life coverage a valuable and customizable tool to add to your financial portfolio. Insurance products may also carry tax advantages, although you should review the taxation treatment of loans, withdrawals, and benefits with your tax adviser before making decisions principally on a taxation basis.

Frequently Asked Questions - Advantages of Life Insurance

What Is the Primary Benefit of Purchasing Life Insurance?

Many people opt to take out a life coverage policy to help ensure their loved ones will be financially provided for if they die. While multiple life insurance products and structures exist, a key feature is the death benefit paid to a named beneficiary.

Are There Any Disadvantages to Having Life Insurance?

Although there isn’t any drawback to having a robust insurance portfolio**, it is important to review all the options carefully and ensure the cost, flexibility, value, and benefits associated with your selected coverage fit your expectations, budget, and familial requirements.

Purchasing Life Insurance Versus Saving: Which Is Better?

There is no universal financial strategy that would be right for every family, and much may depend on your expendable income, lifestyle, age, health, and overall wealth. Some people opt to rely on savings and investments, while others opt for an insurance product with the potential to accumulate an account value.

EL01603A101 (11-24)

*https://www.limra.com/en/research/research-abstracts-public/2024/2024-insurance-barometer-study/

**Subject to IRS limitations. Each year, a 7-Pay Test is performed to determine the status of the Policy. Policies that fail the 7-Pay Test will be known as a Modified Endowment Contract (MEC). Once a Policy is classified as a MEC, the tax preferential treatment is retracted and will be subject to other restrictions and penalties.

This article was generated with the help of artificial intelligence (AI). AI-generated content may occasionally contain errors or misleading information. The information above is for educational use only and does not represent insurance, tax, or legal advice. It is not a recommendation or solicitation to buy insurance. Please talk to your licensed insurance agent for more information about life insurance and your needs. Please consult with the appropriate professional for tax or legal advice. Guarantees are backed by the claims-paying ability of the issuing insurance company.

Article Author: Meredith Bell

Author Bio: Meredith joined Everly in 2022 and has 20+ years of experience in the life insurance industry. She has held various roles in advertising, marketing, communications, sales and distribution support, and product development. Outside of the office, Meredith lives with her daughter Kennedy and their dog Mavis. Meredith enjoys cooking, camping, gardening, hiking, and bourbon (though not always at the same time). She is a live music enthusiast and an avid reader. Her favorite quote is by Thomas Jefferson: "I cannot live without books." Meredith agrees, but would add cheese, movies, and dogs to that list.